Highest Property Tax In Idaho . The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. The median property tax in idaho is $1,188.00 per year, based on a median home value of $171,700.00 and a median effective property. Blaine county ( $1,989) lowest property taxes. The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). The lowest property tax rate, is 0.34% in custer county. The median property tax payment comes in at $1,825 per year. Idaho ( 0.56%) has a. There are three ways to analyze property taxes in 2023. Clark county ( $459) csv json. With new tax relief reducing some school levies and. Median property tax is $1,188.00. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. The highest property tax rate, in idaho is 0.88% in power county.

from texasscorecard.com

The highest property tax rate, in idaho is 0.88% in power county. The median property tax in idaho is $1,188.00 per year, based on a median home value of $171,700.00 and a median effective property. There are three ways to analyze property taxes in 2023. Blaine county ( $1,989) lowest property taxes. Clark county ( $459) csv json. The lowest property tax rate, is 0.34% in custer county. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. Idaho ( 0.56%) has a. Median property tax is $1,188.00. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home.

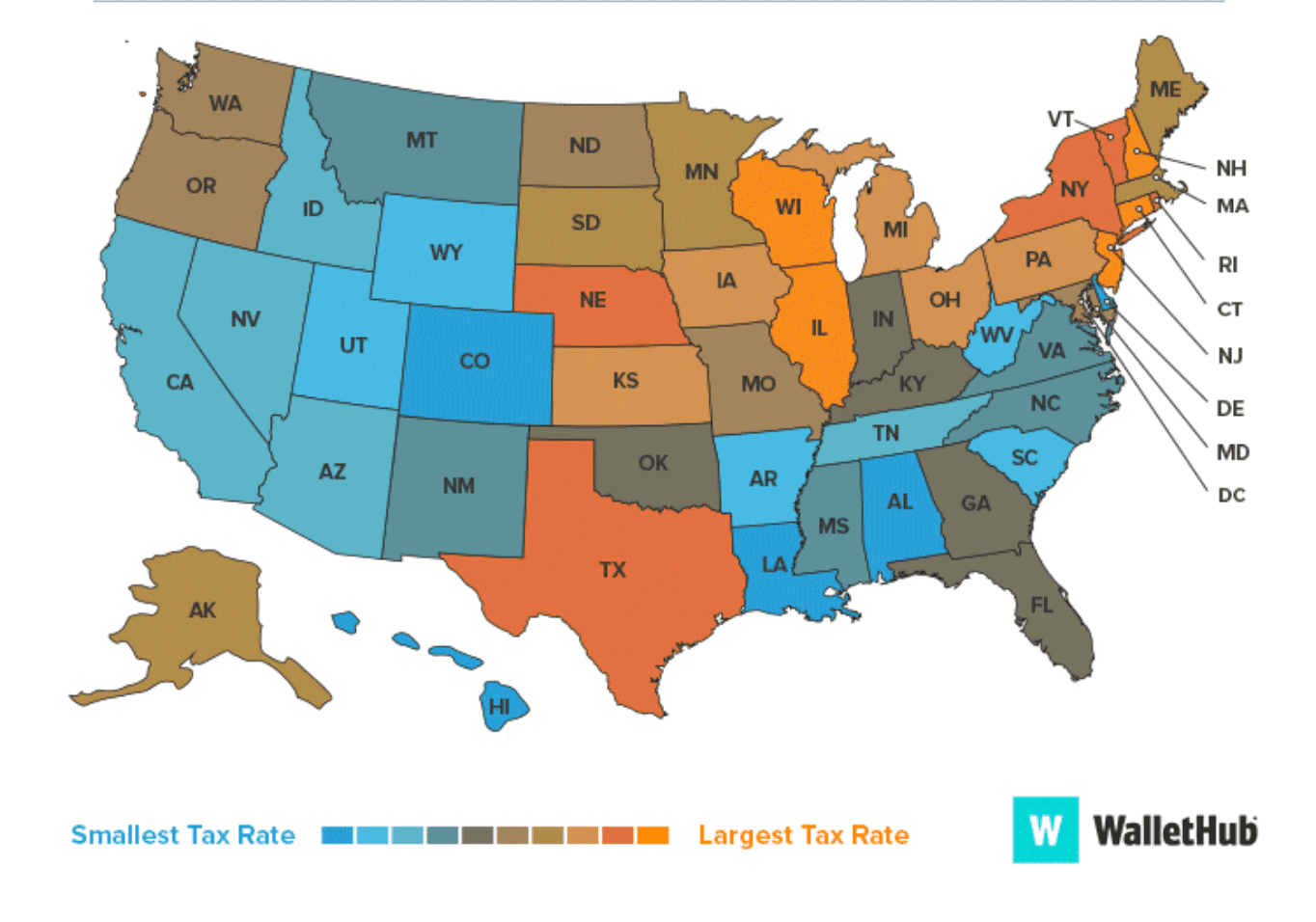

Where Does Texas Rank on Property Taxes? Texas Scorecard

Highest Property Tax In Idaho Clark county ( $459) csv json. With new tax relief reducing some school levies and. The median property tax in idaho is $1,188.00 per year, based on a median home value of $171,700.00 and a median effective property. Clark county ( $459) csv json. There are three ways to analyze property taxes in 2023. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. The highest property tax rate, in idaho is 0.88% in power county. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). The median property tax payment comes in at $1,825 per year. Median property tax is $1,188.00. The lowest property tax rate, is 0.34% in custer county. Blaine county ( $1,989) lowest property taxes. Idaho ( 0.56%) has a.

From shawntracee.pages.dev

2024 Per Diem Rates California Abby Linnea Highest Property Tax In Idaho The highest property tax rate, in idaho is 0.88% in power county. The median property tax payment comes in at $1,825 per year. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. Clark county ( $459) csv json. With new tax relief reducing some school levies and. Idaho ( 0.56%) has a. Blaine county. Highest Property Tax In Idaho.

From www.ktvb.com

Idaho property tax rate raises concerns over homeowner stability Highest Property Tax In Idaho There are three ways to analyze property taxes in 2023. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. The median property tax payment comes in at $1,825 per year. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. Blaine county (. Highest Property Tax In Idaho.

From www.madisontrust.com

What Is the Most Taxed State? Highest Property Tax In Idaho This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. Idaho ( 0.56%) has a. Clark county ( $459) csv json. With new tax relief reducing some school levies and. The median property tax payment comes in at $1,825 per year. The three counties in idaho with the highest effective property tax rates are power. Highest Property Tax In Idaho.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Highest Property Tax In Idaho Idaho ( 0.56%) has a. Clark county ( $459) csv json. There are three ways to analyze property taxes in 2023. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. Blaine county ( $1,989) lowest property taxes. The lowest property tax rate, is 0.34% in custer county. With new tax relief reducing some school. Highest Property Tax In Idaho.

From brandongaille.com

10 US Cities with Highest Property Taxes Highest Property Tax In Idaho The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. Median property tax is $1,188.00. The lowest property tax rate, is 0.34% in custer county. The median property tax payment comes in at $1,825 per year. The median property tax in idaho is $1,188.00 per year, based on a. Highest Property Tax In Idaho.

From tax.idaho.gov

Eligible homeowners can apply online for property tax relief Idaho Highest Property Tax In Idaho The lowest property tax rate, is 0.34% in custer county. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). This interactive table ranks idaho's. Highest Property Tax In Idaho.

From texasscorecard.com

Where Does Texas Rank on Property Taxes? Texas Scorecard Highest Property Tax In Idaho The highest property tax rate, in idaho is 0.88% in power county. With new tax relief reducing some school levies and. Blaine county ( $1,989) lowest property taxes. Clark county ( $459) csv json. The median property tax payment comes in at $1,825 per year. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home.. Highest Property Tax In Idaho.

From www.slideserve.com

PPT PROPERTY TAXES AND IDAHO’S SYSTEM PowerPoint Presentation, free Highest Property Tax In Idaho There are three ways to analyze property taxes in 2023. Idaho ( 0.56%) has a. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. Clark county ( $459) csv json. The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%).. Highest Property Tax In Idaho.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Highest Property Tax In Idaho The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. The median property tax in idaho is $1,188.00 per year, based on a median home value of $171,700.00 and a median. Highest Property Tax In Idaho.

From myemail.constantcontact.com

does your state impose high taxes? Highest Property Tax In Idaho Blaine county ( $1,989) lowest property taxes. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. The highest property tax rate, in idaho is 0.88% in power county. Idaho ( 0.56%) has a. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home.. Highest Property Tax In Idaho.

From www.ualrpublicradio.org

Rep. David Ray discusses issues the legislature will address in special Highest Property Tax In Idaho The median property tax in idaho is $1,188.00 per year, based on a median home value of $171,700.00 and a median effective property. Idaho ( 0.56%) has a. The highest property tax rate, in idaho is 0.88% in power county. With new tax relief reducing some school levies and. This interactive table ranks idaho's counties by median property tax in. Highest Property Tax In Idaho.

From local.aarp.org

Illinois State Tax Guide What You’ll Pay in 2024 Highest Property Tax In Idaho There are three ways to analyze property taxes in 2023. Idaho ( 0.56%) has a. The median property tax payment comes in at $1,825 per year. Blaine county ( $1,989) lowest property taxes. Median property tax is $1,188.00. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the state of idaho. This. Highest Property Tax In Idaho.

From alaskapolicyforum.org

Alaska Property Taxes, Ranked Alaska Policy Forum Highest Property Tax In Idaho The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). Blaine county ( $1,989) lowest property taxes. There are three ways to analyze property taxes in 2023. Clark county ( $459) csv json. Idaho ( 0.56%) has a. The lowest property tax rate, is 0.34% in. Highest Property Tax In Idaho.

From www.dpgo.com

States with Highest Property Tax Rates DPGO Highest Property Tax In Idaho The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). Blaine county ( $1,989) lowest property taxes. The lowest property tax rate, is 0.34% in custer county. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. Median property tax is. Highest Property Tax In Idaho.

From boisedev.com

Explain this to me Inside Idaho's complicated property tax system Highest Property Tax In Idaho The lowest property tax rate, is 0.34% in custer county. The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). There are three ways to analyze property taxes in 2023. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. The. Highest Property Tax In Idaho.

From www.hawaiifreepress.com

What you need to know about property taxes in Hawaii > Hawaii Free Press Highest Property Tax In Idaho There are three ways to analyze property taxes in 2023. The highest property tax rate, in idaho is 0.88% in power county. Blaine county ( $1,989) lowest property taxes. The median property tax payment comes in at $1,825 per year. This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. With new tax relief reducing. Highest Property Tax In Idaho.

From marketplace.lmtribune.com

Second Half 2023 Property Taxes, Idaho Property Taxpayers Highest Property Tax In Idaho The median property tax payment comes in at $1,825 per year. The three counties in idaho with the highest effective property tax rates are power county (0.88%), bannock county (0.87%), and nez perce county (0.86%). Blaine county ( $1,989) lowest property taxes. The county’s average effective property tax rate is 0.89%, which ranks as one of the highest in the. Highest Property Tax In Idaho.

From stateimpact.npr.org

Idaho Ranks 21st in the Annual State Business Tax Climate Index Highest Property Tax In Idaho This interactive table ranks idaho's counties by median property tax in dollars, percentage of home. Clark county ( $459) csv json. Blaine county ( $1,989) lowest property taxes. The median property tax in idaho is $1,188.00 per year, based on a median home value of $171,700.00 and a median effective property. The lowest property tax rate, is 0.34% in custer. Highest Property Tax In Idaho.